Providing the right products for your customers will always involve a bit of guesswork, but you can narrow it down by using tools to analyse what people are searching for online - and what products are seeing increasing or decreasing search volumes.

In the first of a new series, we used two tools, Ahrefs, which provides data for millions of keywords and products, and Google Trends, which tracks changes in the popularity of products, to analyse the competing popularity of different vape kits.

It’s important to use both tools, because Ahrefs’ strength lies in calculating search volume, while Google Trends is superb at detecting changes in demand.

Analysis

For this analysis, we’re focussing on kits, and we’re looking at independent (non-tobacco brands) only. We’ve narrowed our search to the UK, and we’re looking at the past 30 days only (ending 6th October), so we get the most current data available.

| Kit | Number of searches (UK) |

| Smok Nord | 17000 |

| Aspire Pockex | 10000 |

| Geekvape Aegis | 8,200 |

| Voopoo Drag 2 | 4,600 |

| Smok Novo | 4,300 |

| Uwell Caliburn | 3,500 |

| Smok RPM40 | 3,200 |

| Smok Vape Pen 22 | 3,100 |

| Uwell Nunchaku | 2,700 |

| Smok Species | 2,600 |

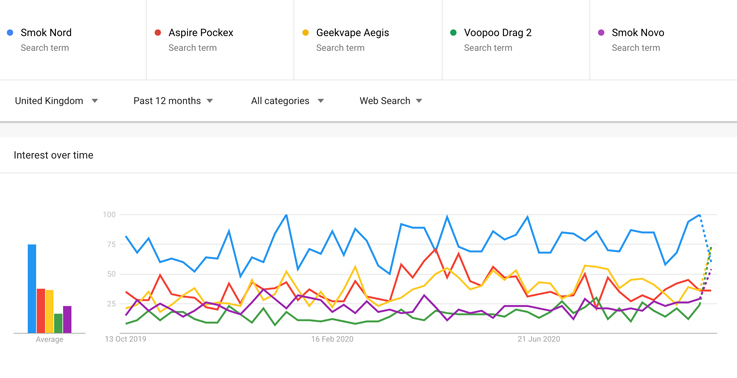

That gives us some idea of current search volume over the last 30 days, but it doesn’t tell us how trends are changing. To examine that further, we plugged the top five products into google trends to see how trends have changed over the past twelve months.

The Smok Nord is not only the most popular, it seems to have consistently good results, perhaps boosted by the launch of the Smok Nord 2. In contrast, the Aspire Pockex, the oldest device on this list, seems to have peaked in popularity, although we are convinced this will remain a good seller for some time to come.

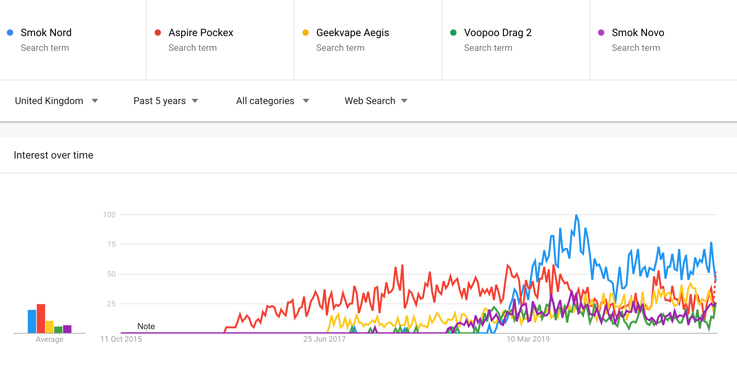

We also looked back at the last five years to see if that would tell us a different story.

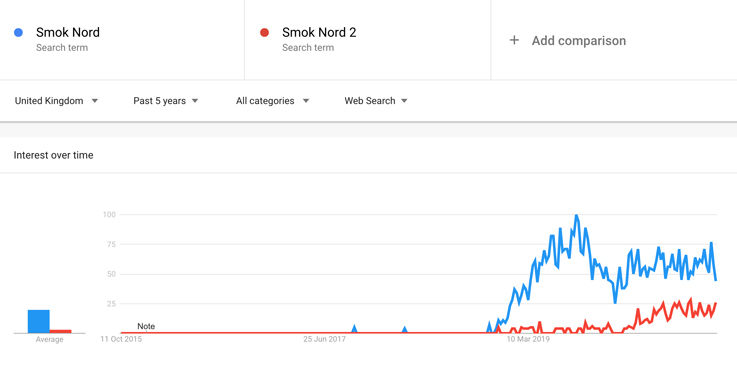

This shows more clearly that the Pockex is on a slow, albeit jagged, decline while the Smok Nord also seems to be past it’s peak - although some of which will be due to smaller but growing searches for the Smok Nord 2...

In contrast, the Geekvape Aegis seems to be showing a steady increase in popularity.

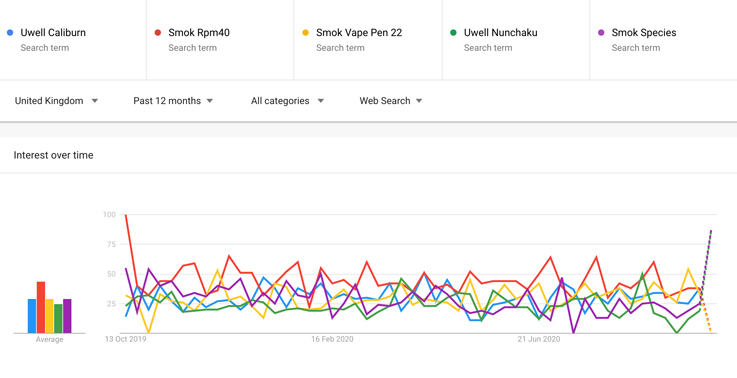

Let’s see how the next 5 products stack up in terms of popularity.

It’s intriguing to see how well the Smok Species, an older system and one that has been discontinued, has maintained its keyword searches, although I suspect the Google Trends prediction (which is based on partial data) here is over-optimistic.

It will also be interesting to keep an eye on the Uwell Caliburn - the combination of a consistently popular product with the launch of a new version (the Uwell Caliburn G) could make the Caliburn G a sensible product to get in stock.

Limitations

There are some inherent limitations here. Ahrefs tracks keywords, and there may be variants which are counted as two keywords. For example, Geekvape Aegis (5,300 searches) and Geek Vape Aegis (2,900) are the same product, but are counted separately. (For this analysis we have combined the two, but we won’t pick up every variation.)

Secondly, Ahrefs can only make use of the keyword data made available to it by Google, and in general will underestimate the total number of searches - and may not always be 100% accurate.

Thirdly, some people will search for an older brand, but end up buying a newer brand. For example, people may search for the Smok Nord, but as google auto-completes their search, they are likely to navigate to the Smok Nord 2. Similarly, people may search for Aegis Boost, but end up buying the Aegis Boost Plus.

That said, bearing in mind these limitations, these tools can give us a strong overall indication of what products are popular and trending.

Summary

As you will know, getting the right products for your customers requires both different skills and different sources of information.

Decisions will be informed by your own product knowledge, by intuition, customer feedback, margins and more.

Keyword and trends analysis don’t replace these skills. Instead they complement them, adding a further tool to your belt to help ensure you have the right products in place at the right time.